CyberCX

Securing our communities

We partner with enterprise and government organisations to defend against cyber threats and embrace the opportunities of cloud.

Be empowered to manage cyber risk, build resilience and grow with confidence in an increasingly complex and challenging threat environment.

Manage risk

Expert guidance at scale to help your organisation manage cyber risk and ensure best practice data and digital governance.

Build resilience

Safeguard your digital assets and be prepared to respond and bounce back when the unexpected occurs.

Grow with confidence

Be empowered to optimise opportunities on your digital transformation journey.

Latest insights

In-depth analysis and the latest intelligence from our leading cyber security experts.

Digital Forensics and Incident Response: 2023 Year In Review

Insights into the Australian and New Zealand Cyber Attack Landscape in 2023

An unlevel playing field: Global sport and cyber threats

CyberCX report highlights increased cyber risks to global sport, and Australia is a target

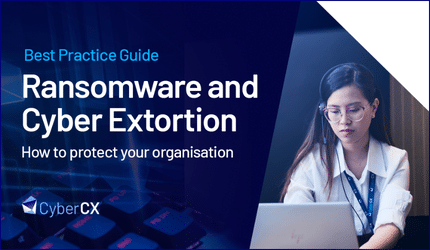

Ransomware and Cyber Extortion: Best Practice Guide

CyberCX launches updated Ransomware and Cyber Extortion Best Practice Guide

Subscribe to Cyber Adviser

Get the latest insights and expert analysis from the CyberCX Intelligence desk.

Trusted cyber security partner to leading Australian organisations.

Ready to get started?

Find out how CyberCX can help your organisation manage risk, respond to incidents and build cyber resilience.

Customer success stories

See how CyberCX has helped organisations, both big and small, meet their security and business transformation requirements.

Penetration testing

Protect your digital assets and ensure operational resilience with comprehensive security testing from the region’s largest and most experienced team of certified testing experts.

Manage cyber risk

Expert guidance at scale to help manage risk, enhance control over operations, increase profitability, and ensure you meet legal, contractual and regulatory compliance obligations.

Incident response

When the unexpected happens, you need the resilience to minimise impact and bounce back. Act quickly to identify the cause and respond with confidence by engaging internationally recognised experts with local insight.

Cyber security services

End-to-end services covering every challenge throughout your cyber security and cloud journey.

Careers in cyber security

Join Australia’s greatest force of cyber security professionals.

Australia’s trusted

cyber security and cloud partner

Expertise at scale

More than 1,400 cyber security and cloud professionals delivering solutions to our customers.

Eyes on glass 24/7

Continuous monitoring of your network across our 9 advanced security operations centres globally.

Help when you need it

The region’s largest team of incident responders handle over 250 cyber breaches per year.

Assessing your needs

Industry-leading experts conduct more than 500 baseline security assessments per year.

Providing credible assurance

Our exceptional team of ethical hackers conducts over 3,000 penetration tests per year.

Training the next generation

The CyberCX Academy is training 500 cyber professionals over the next three years.